Updated: Sept 22, 2020

“How much do I need to retire?”

and

“How much money should I have saved by 30, 40, or 50?”

These questions plague people who worry about maintaining their standard of living during retirement age.

No doubt you want a simple answer to these questions. Most people do. (“Just give me a number already!”)

The answer is anything but simple. It depends on a lot of variables that are unique to you, which means I can’t give you the number that’s right for you.

But, you can take some steps to calculate that number for yourself!

That response may sound like a cop-out, but it’s not… I promise. 😊

While I can’t tell you what your number is, the whole point of this post is to give you a method of estimating that number for yourself.

And that’s exactly what we will do!

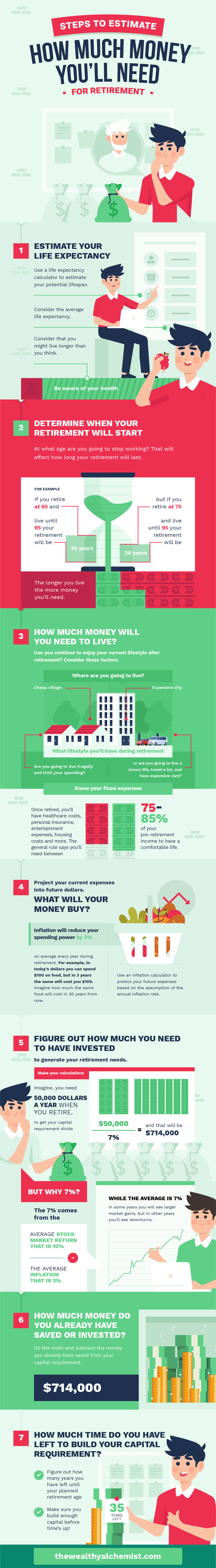

First, check out this infographic to see the steps visually, and get more details in the post afterward!

Contents

- 1 7 Steps to Estimating Your Number

- 2 1. Estimate Your Life Expectancy

- 3 2. Determine When Your Retirement Will Start

- 4 3. How Much Money Will You Need To Live?

- 5 4. What Will Your Money Buy After Inflation?

- 6 5. Figure Out How Much You Need to Save And Invest

- 7 6. How much do You Already Have Saved or Invested?

- 8 7. How Much Time do You Have Left?

- 9 Final Thoughts On How Much Do I Need to Retire

Steps to Calculate Your Retirement Needs

Best Resources to Plan For Your Retirement

Acorns: Acorns is the perfect app if you’re a beginner investor! It rounds up your purchases to the nearest dollar and invests the change. Acorns also has an automated retirement account to make things easy!

Stash: Stash is an easy-to-use investment app that’s great for beginners. It lets you invest in thousands of stocks or ETFs for $1 or less.

Personal Capital: Personal Capital is financial software with tools for long-term financial planning, money management, and retirement planning. Keep track of your cash flow, net worth, and portfolio with their robust tools.

7 Steps to Estimating Your Number

To figure out how much money you need to save for retirement, you’ll first need to estimate your

- Life expectancy

- Annual income requirements

- Future market growth rates

- Future inflation values

But how can anyone know that?

Nobody can know that for certain, but there are ways to make some reasonable estimates.

Want to know how? Let’s do it!

Suze Orman Money Advice:

Before we figure out what you need to have invested to retire, here’s a video with Suze Orman sharing her best advice to help your money go farther during retirement.

1. Estimate Your Life Expectancy

Let’s start with the most foreboding question first. How long do you think you’ll live?

It’s worth thinking about it now because the last thing you want is to run out of money before you run out of time!

In fact, one of the biggest fears of current retirees is outliving their retirement savings, so you definitely want to factor your life expectancy into your retirement plan now!

But how on earth are you supposed to do that? You (presumably) don’t have a crystal ball foretelling the day and time of your impending doom…. but, there’s one site that comes close.

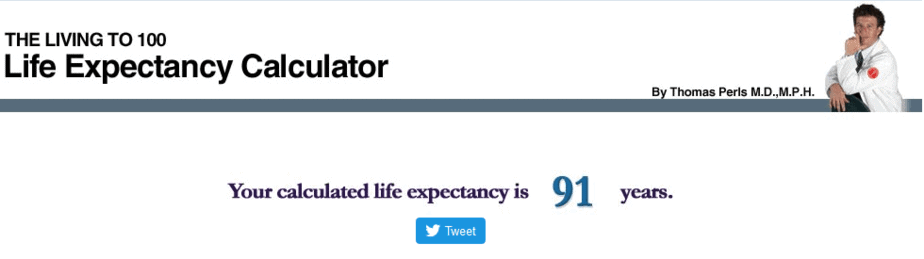

Living to 100

It’s called livingto100.com and it was created by Thomas Perls MD, MPH.

FYI: Dr. Perls is the founder and director of the New England Centenarian Study, the largest study of centenarians and their families in the world. Using the data he’s collected, he created a free online calculator that will estimate your life-expectancy based on your lifestyle. (You’ll just have to enter your email)

Their life expectancy calculator asks you everything from your cholesterol levels, to your marital status and even your flossing habits.

While he doesn’t guarantee 100% accuracy in his calculator, it is fun to take and gives you as good an estimate as you will get anywhere else.

Once you get a life expectancy estimate, you can tentatively plan the length of your retirement from there.

(FYI, my life-expectancy estimate was 91 years 😊… which means I could be in retirement for nearly thirty years) ![]()

2. Determine When Your Retirement Will Start

Now that you’ve got a life expectancy estimate, you’ll need to think about your retirement age. Maybe you want to leave work at age 65. Maybe earlier. Maybe later.

Either way, once you decide your retirement age, you can use it with your life expectancy to estimate how long your retirement will last.

For example,

- If you retire at age 75 and live until 95, your retirement will last 20 years

- If you retire at age 65 and life until 95, your retirement will last 30 years

Play around with the numbers to see just how long your retirement could last. And remember, you might live longer than you think!

Related Post: Early Retirement Pitfalls You Need To Avoid

3. How Much Money Will You Need To Live?

To figure out how much you have to save for retirement, you first have to figure out your expenses.

Keep in mind, the cost of living during your golden years may be more than you think!

Over the year’s financial planners have developed formulas and rules to help us figure it out, but the general rule is that you’ll need 75%-85% of your pre-retirement salary to have a comfortable retirement.

So, if you were making $100,000 a year right before retirement, you’ll want your post-retirement income to be $75,000-$85,000.

Why 75-85 Percent?

The reason they recommend 75-85% of your pre-retirement income is that you’ll be able to cut out a lot of job-related expenses such as commuting, lunches, work clothes, etc.

You probably won’t have a mortgage by the time you retire.

And you’ll be able to take your vacations during the cheaper part of the year instead of when your job lets you (which is usually the most expensive time to travel).

On the other hand, you’ll be spending more on healthcare and prescription drugs, utilities, and property taxes.

So overall, financial planners determined around 75-85% should be good.

Estimate Your Actual Retirement Expenses

Ok, 75-85% is an excellent rule of thumb to follow, but another option is to try estimating your actual future expenses.

Look back at what you’ve been doing and assume you’ll spend more or less the same amount of money on your habits.

If you track your expenses, then it should be easy enough to analyze your past spending.

If not, then go through your last year or two of your bank statements. (Hopefully, you do online banking!) and see where all your money has been going.

Hey! If you want to track your expenses the easy way, Personal Capital is for you! Personal Capital tracks all your spending, and categorizes it instantly!

And best of all, it’s expense tracking is free! Sign up for Personal Capital!

There are some assumptions you’ll have to make based on your plans. Take these factors into account when estimating your retirement expenses:

- Where do you plan on living during retirement? In a small town or a big city?

- Do you plan on living a simple, frugal life or do you want to live in luxury?

- Are there any hobbies you plan on picking up once you retire?

These approaches will give you some idea of the amount of money you’ll need. But there’s one more thing you have to consider when calculating your expenses…inflation.

4. What Will Your Money Buy After Inflation?

Inflation is when prices increase and your purchasing power falls.

Let’s illustrate it with a quick example.

Imagine you save $20 under your mattress today and forget about it. Fifty years later you find it again, but because of inflation, that $20 is just enough to buy a gallon of milk.

That’s what inflation will do to your savings if it’s under a mattress, or in a shoebox, or anywhere it’s not earning a return.

And that’s what inflation means for your retirement expenses. That gallon of milk you pay $5 for today, isn’t going to cost $5 when you retire!

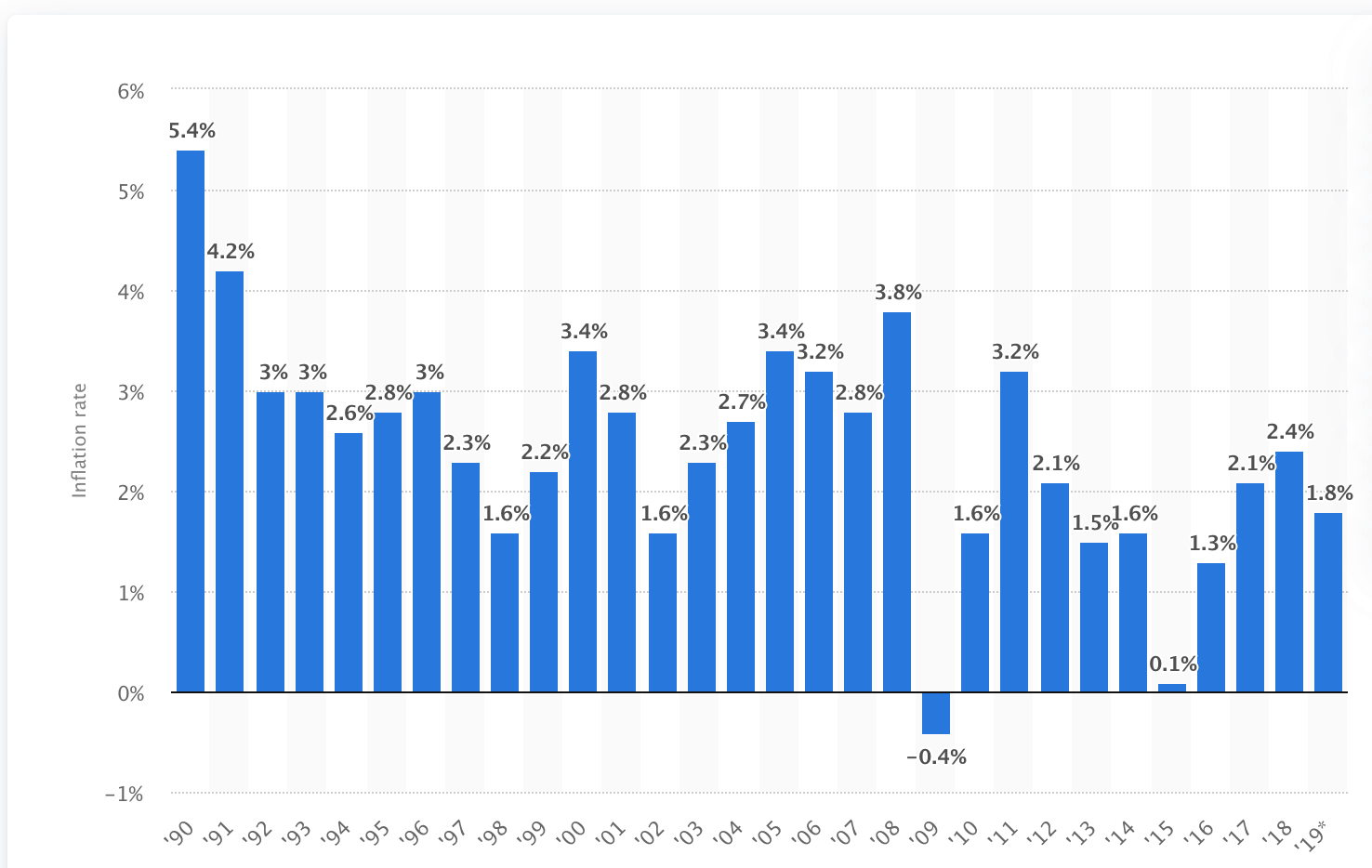

Over the last 80 years, inflation has been pretty stable and has averaged around 3% per year.

Because of this many people who plan for retirement assume that their purchasing power will lose around 3% of its value every year.

This might seem like a reasonable assumption to make based on history, but there’s a problem.

The Problem With Average Inflation

There’s a famous story that illustrates the problem with using the average inflation rate when calculating retirement.

It goes like this…

There once was a man who tried to walk across a river with an average depth of 3 feet. He ended up drowning in that river.

How? Because the depth of the water was only ankle deep near the banks but was 9 feet deep in the middle.

He drowned because he thought the average depth was the same in every part of the river!

The problem with averages is that they look at everything as a whole and don’t tell us what’s happening at a specific point.

Because of that, plans based on assumptions using averages can go wrong.

So, while the average historic inflation rate has been 3%, the inflation rate for any given year could have been something way different.

Best Resources to Plan For Your Retirement

Acorns: Acorns is the perfect app if you’re a beginner investor! It rounds up your purchases to the nearest dollar and invests the change. Acorns also has an automated retirement account to make things easy!

Stash: Stash is an easy-to-use investment app that’s great for beginners. It lets you invest in thousands of stocks or ETFs for $1 or less.

Personal Capital: Personal Capital is financial software with tools for long-term financial planning, money management, and retirement planning. Keep track of your cash flow, net worth, and portfolio with their robust tools.

Historical Inflation

Check out the U.S average inflation rate from 1990-2019

Source: Statista.com

Now imagine that you retired with your nest egg in 1979 thinking you would lose only 3% of your value the next year. And when 1980 came, you lost nearly 13% of your value!

Scary…

So, you see how dangerous making assumptions based on average rate!

But what else are you supposed to do?! Assuming a 3% inflation rate isn’t perfect, but there’s really no better option.

But just knowing that the average inflation rate isn’t necessarily what you’ll see this year or the next will help you be prepared.

And any retirement savings you have for the future will have to survive inflation and last the rest of your life.

How to Estimate Your Future Purchasing Power

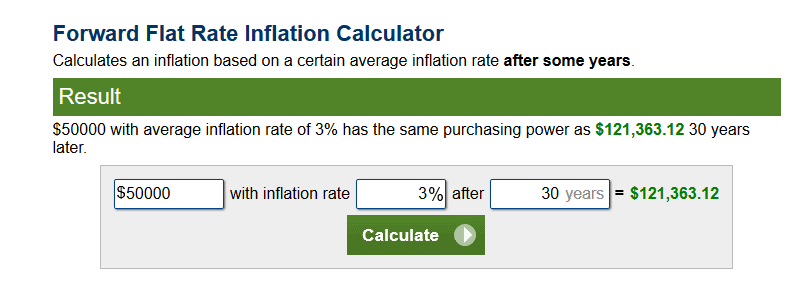

Let’s say you estimated that you need $50,000 of annual income (adjusted for inflation) to live comfortably after you retire.

But aren’t you curious to know how much that will be after inflation?

To estimate your future income needs, you can use the Future Foward Flat Rate Calculator.

Go to the calculator and enter

- A dollar amount in today’s dollars ($50,000 for example),

- The estimated annual inflation rate (3%), and

- How many years you want to project. (This will be the number of years until you retire.)

and voila!

$50,000 today will be equal to $121,000 in 30 years!!

Hey! You want to start investing, but you just don’t have the cash? Give Acorns a shot. This app will round up your purchases to the nearest dollar and invest the change! Sign up with Acorns here!

5. Figure Out How Much You Need to Save And Invest

Ok, so you’ve figured out your income requirements during retirement. You also see why it’s necessary to have your nest egg invested in the market.

Now you have to figure out how much you’ve got to have invested!

But how do you do that?

Well, there are a few ways to do it.

Use a Retire Calculator

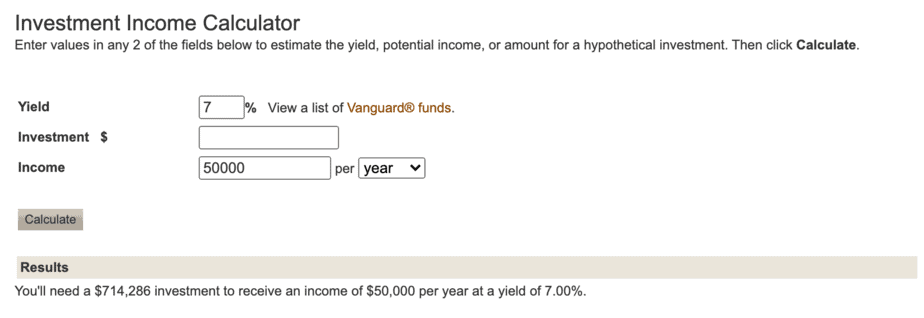

Here’s a link to Vanguard’s investment income calculator. We’ll have to plug a few assumptions into the calculator but it’s pretty easy to use.

You just have to add the yield (your expected return) and the annual income you need.

Let’s say you’ve calculated that you need $50,000 of annual income (adjusted for inflation per year) to live comfortably during retirement. Enter $50,000 into the income box.

Now, since the average annual stock market return is 10% and the average historical inflation rate is 3%. We’re going to enter 7% (10% – 3%) as the yield.

The reason we must subtract inflation is that you’ll need to use 3% more money every year just to buy the same same. (Remember you’re losing buying power every year).

So, while you may earn 10% in the market, your real earnings after inflation is only 7%.

Hit the calculate button and Vanguard will tell you how much you need to save to generate your retirement income.

Vanguard tells you that you need $714,000 to retire.

Do a Retirement Calculations Yourself

You don’t actually have to find special calculators for retirement to find your capital requirement. All you need is your cell phone calculator.

FYI: By capital requirement, we just mean the amount of money you need to have invested to generate your required income.

To do this quick retirement cal yourself, simply take your income requirement ($50,000) and divide it by the yield (7%).

This will give you a quick answer to the question “how much do I need to retire?”

Rule of 72

There’s a neat trick to helping you figure out how long it will take inflation to cut your buying power in half. It’s called the Rule of 72. This is how it works:

Inflation has been an average 3% historically. So, take 72 and divide it by 3. This tells you that your buying power will be cut in half in 24 years.

It also works for figuring out how long it takes to double your money. So if you expect to earn 6% on an investment, dividing 72 by 6 tells you that your money will double in 12 years!

When you plan your retirement you should take into account, the Rule of 72 to estimate how much your money will grow and how much your spending power may be reduced.

The Importance of Investing

I can’t stress enough how important it is to invest your retirement savings to earn a return.

Like we saw above, if you just have your money sitting in a shoebox somewhere, you will lose some of your buying power every year.

But if you’ve got it invested and are earning 10% every year, you’ll be offsetting the inflation rate and earning 7% overall (10% – 3%).

Choosing to invest will do two things for you:

1. Instead of losing purchasing power, your savings will keep up with inflation. This means you don’t have to take inflation into account when calculating your retirement expenses.

2. Your savings should earn an income above inflation. This means you can live off your investment earnings instead of living off your capital.

Where to Invest

But what should you invest in? Well, I can’t tell you where you should invest, but the higher the risk, the higher the return.

Higher risk investments include Initial Public Offerings and Foreign Emerging Markets. Lower Risk are things like U.S. Treasure Bonds.

In theory, the higher your risk tolerance, the faster you can reach your retirement goal (and the higher the chance of you losing your money).

And the lower your tolerance for risk, the more time you’ll need for your investments to grow to reach your retirement goal.

You’ll just have to determine what your risk appetite is and go for it.

Some Investment Choices

There are plenty of investment options to choose from, but some common choices are:

- Employer-sponsored accounts (traditional 401 k, roth 401 k, solo 401 k)

- IRA plans

- REITs

- Bonds

- Individual Stocks

- CDs

- Exchange Traded Funds

6. How much do You Already Have Saved or Invested?

Now you know exactly what you must have to generate your retirement income.

But wait! There’s still more to do!

Before we can say how much you still must save, we have to know how much you’ve got!

If your capital requirement is $714,000 and you’ve saved $100,000 so far, you have to save and invest $614,000.

If you haven’t saved anything yet, no worries! You just have to save the whole amount.

Related post: Use These Money Saving Challenges to Stockpile Thousands

7. How Much Time do You Have Left?

Whether you have to save a little or a lot, you’ve got to do it before you retire.

If you plan on retiring in 30 years, then make sure your savings rate is high enough to build enough capital!

If you don’t think you can realistically achieve your goal in the time you have left, consider retiring later in life, or finding new ways to generate income so you can increase your savings rate!

Related post: Creative Ways to Save Money

Don’t Forget About Social Security Income

You’ve got to have investments to generate enough income during your golden years. But don’t forget that social security is another one of the income sources you may get as well!

But depending on your work history and salary information, you might get a significant amount of social security not.

Whether it’s a lot or a little, it won’t be enough to pay for all your expenses. But it will reduce the amount of income your investments have to generate.

For example,

- if your annual expenses are $50,000,

- and you get $18,000 a year from social security,

- your investments only have to generate $32,000 of income a year ($50K – $18K).

So, you won’t need to save as much as you thought if you take social security into account!

If you want to learn more about how social security check out Retirement Pitfalls to Avoid.

Best Resources to Plan For Your Retirement

Acorns: Acorns is the perfect app if you’re a beginner investor! It rounds up your purchases to the nearest dollar and invests the change. Acorns also has an automated retirement account to make things easy!

Stash: Stash is an easy-to-use investment app that’s great for beginners. It lets you invest in thousands of stocks or ETFs for $1 or less.

Personal Capital: Personal Capital is financial software with tools for long-term financial planning, money management, and retirement planning. Keep track of your cash flow, net worth, and portfolio with their robust tools.

Final Thoughts On How Much Do I Need to Retire

If you started out asking “how much do I need to retire?”, I hope you see now that it’s not a hard problem to solve!

In a few easy steps, you can come up with realistic estimates and a plan to make your retired life comfortable!

One important thing to remember is to not be intimidated by the numbers. Come up with your estimates and start saving as soon as you can!

Cheers!

Related post: Best Frugal Living Tips to Simplify Your Life!

Oliver

Latest posts by Oliver (see all)

- 26 Best Personal Finance Tips To Rock Your Money! - November 18, 2020

- How Much is 6 Figures? Epic Salaries Explained. - September 10, 2020

- Is Ibotta Legit? The Most Complete Ibotta Review 2021 - April 15, 2020

Super-helpful post; a great conversation starter! Have scheduled for my FB feed 🙂

Hi, Thank you so much!! Glad you enjoyed our post.

this is a really good post about saving for retirement! this should be taught to high school kids so they understand early savings/investments will go a long way when they unemployed or retired!

financial planning as a subject has to be a must in all schools

Hi, yes I agree with you! Thanks for stopping by.