The popularity of the FIRE (Financial Independence Retire Early) movement has shown us just how many people are gunning for early retirement. But it isn’t all peaches and cream. There are some easy-to-miss retirement pitfalls you’ll want to look out for.

From not knowing how much money you’ll need to retire, to not understanding how government benefits work, and more.

So, before you continue your early retirement plan, let’s take a few minutes to talk about some of those issues and what you can do to avoid them.

Related Post: How Much Money Should I Have Saved for Retirement?

Contents

- 1 First Off… What is Early Retirement?

- 2 Does it Make Sense to Retire Early?

- 3 Pitfall 1: Not Understanding How Social Security Payments Work

- 4 Pitfall 2: Getting Into Debt

- 5 Pitfall 3: Underestimating Your Healthcare Costs

- 6 Pitfall 4: Not Having a Financial Plan When You Retire

- 7 Pitfall 5: Not Taking Market Fluctuations and Inflation Into Account

- 8 Pitfall 6: Forgetting What Retiring Means To You Once You Get There

- 9 What Are The Three Biggest Pitfalls To Sound Retirement Planning?

- 10 Final Thoughts

First Off… What is Early Retirement?

If I tell you that some guy retired early, you’d probably assume he retired in his 30s or 40s, right?

I would. I’m sure most people would.

But not the U.S. government!

According to the U.S. government, if you retire before you’re 67 years old, you’ve retired early.

Why is this important? Because the government has penalties to slap you with if you retire before 67 (a.k.a. normal retirement age). They also have benefits you can’t access until you reach a certain age (i.e. Medicare at 65).

These problems might not cause too much trouble if you retire early as a 63-year-old, but they can be a pain in the budget if you retire as a 43-year-old.

So, for our purposes, we will discuss problems for people who want to retire before 67.

Does it Make Sense to Retire Early?

I know the FIRE crowd is huge, but for some of us, it might not make sense to retire early.

When it Doesn’t Make Sense to Retire Early

If you’re not financially ready, retiring early may not make sense and you should keep working until you’re financially set.

You should also consider your life expectancy. You may have a lot saved, but if you retire early, can you survive for another 30, 40, or 50 years without working? If not, you might not want to retire now.

Retiring early can also reduce your government benefits. So, if you’ll need to rely on government payments while retired, it won’t make sense to retire early. (More on this in Pitfall #1.)

When it Makes Sense to Retire Early

Retiring early may make perfect sense if you’re sure you have enough money to retire and live the life you want.

If you hate your job and want to do something part-time for less money and more satisfaction, it could also make sense for you.

Only you can decide if it makes sense to retire early, but if you do it, here are a few issues you’ll want to look out for.

Pitfall 1: Not Understanding How Social Security Payments Work

Chances are, you haven’t thought much about the details of the Social Security Administration (SSA). Few of us have. We do know that they take money from our checks today and will, in theory, send us a monthly check once we retire.

But as you might suspect, early retirement introduces complexities into the process. Specifically, it affects:

- your payment calculation

- potential “penalties”

Payment Calculations

The SSA takes your 35 highest-paid working years and uses that information to calculate your benefits. But what happens when you retire early after only 25 years of working?

They’ll use your real salary for those 25 years, but for the other 10 years, they’ll use zeros.

Those zero years mean the payments you receive won’t be as large as they could have been.

Early Retirement Penalty

Although 67 is the normal retiring age, you can start getting SSA payments as early as 62. (Which is technically an early retirement, although I’m sure it doesn’t feel that way.)

If you do get your payments early, the government will reduce your monthly payments by as much as 30%!

The thought process here is that if you collect early, you’ll collect over a longer period, so your check should be smaller.

Many retirees have plans for their benefits. But if you’re not aware of the SSA’s process, you’ll end up leaving money on the table.

The table below shows how much the benefits will be reduced based on the age you decide to retire

Starting Benefits Age | Your Benefits Will be Reduced by: |

62 | 30% |

63 | 25% |

64 | 20% |

65 | 13.3% |

66 | 6.7% |

67 | 0% (you'll collect the full amount) |

Note: These percentages only applies if you were born in 1960 or later | |

Source: ssa.gov | |

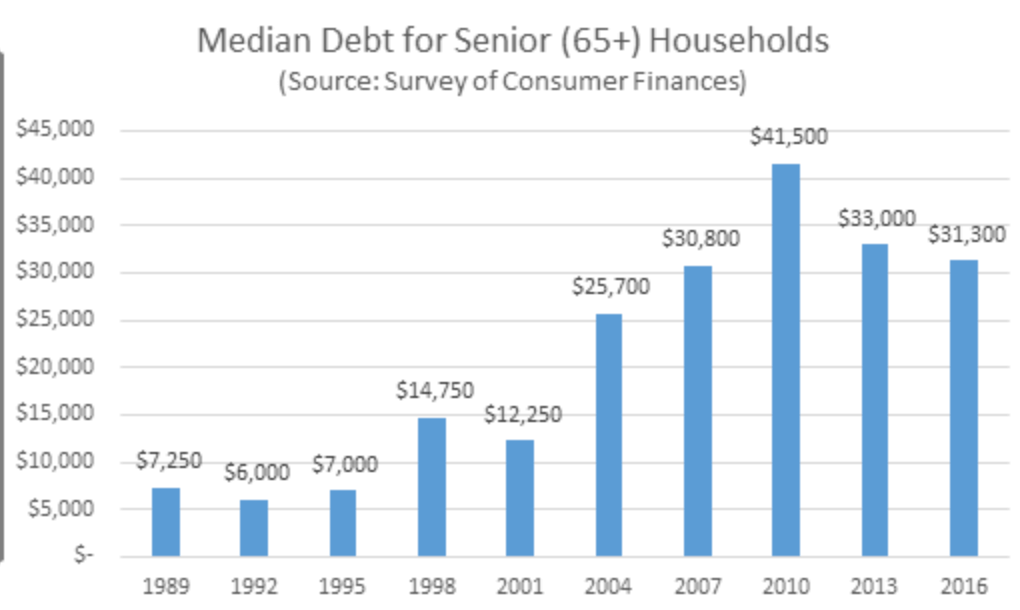

Pitfall 2: Getting Into Debt

Many financial gurus recommend getting out of debt before you retire.

But getting back into debt after retirement is a mistake that many people make for various reasons.

Maybe your car got totaled and you buy a new one. Or there’s a hole in your roof, and now you’re looking at tens of thousands of dollars in repairs you didn’t plan on.

In those cases, debt looks like a tempting solution. But whatever the reason, debt poses a serious threat to the financial independence, retire early (FIRE) lifestyle.

Debt Shortens Your Saving’s Life Expectancy

When you get into debt, you’re borrowing from your future self and spending the money today. But when we retire, most of us will live on a fixed income, so our future selves won’t ever have any extra money.

This means any debt we get into after we retire could force us to forgo some things we need. Or it could force us to withdraw more money from our retirement accounts and eat up our nest egg faster.

Debt Stresses You Out

Another reason you want to avoid debt after you retire is that it stresses you out. Even though your goal is to retire young, you will get older. And with health care costs rising as you get older, the last thing you want is debt-related stress affecting your health.

Either way, this is a pitfall you want to avoid.

View Full report: ncoa.org

Consider This

There are different types of debt, good debt and bad debt.

You should avoid debt after you retire. But using good debt during your working years to gain assets, like real estate, can help you retire early.

Also, before you retire, consider all the major purchases you might need to make after you retire. You will need to buy a car eventually, make a few house repairs, or buy some new furniture.

Consider all these things early in your retirement plan to reduce your chances of having to borrow money later on.

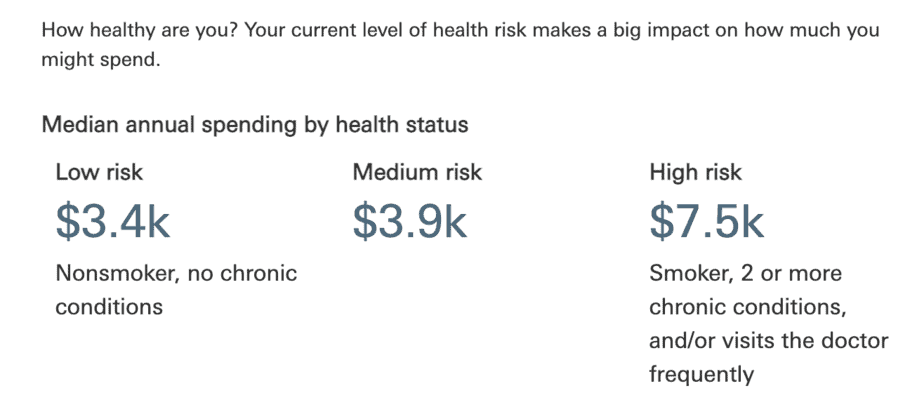

Pitfall 3: Underestimating Your Healthcare Costs

When you think about retiring early, what do you imagine yourself doing? Traveling the world? Maybe eating out at exotic restaurants? Or how about writing a science fiction novel? Now that would be cool…

Whatever it was you imagined, I bet you didn’t picture yourself writing hefty checks to your health insurance company.

That’s understandable because most young retirees are healthy and have other priorities. It’s worth keeping in mind though that you’re not eligible for Medicare until you turn 65.

This means that if you retire at age 40, you’ll pay for your early retirement health insurance costs from the time you’re 40 until you’re 65. (And I’m not even considering spouses and children here!)

That’s 25 years of increasing health insurance costs and hospital services that will come 100% out of your budget!

That’s a sobering thought. And we’re not the only ones worried about it. In fact, 38% of Baby Boomers say that health costs are a top fear.

Source: Vanguard.com

What can you do about it?

- Look into faith-based health insurance alternatives

- Consider creating a tax-favored health savings account now before you retire,

- Check out the Affordable Care Act

- There are other plans out there as well. A financial planner can help you find the right one for you.

Pitfall 4: Not Having a Financial Plan When You Retire

It takes a lot of discipline to save your money and build investments so you can retire.

Once you retire though, retired living may tempt you to think you’ve arrived in the Promised Land and that you can take it easy.

In one sense, this is true. But in another sense, it’s a mistake that can cause you to lose control of your money.

The truth is, once you retire, you must work as hard to manage your nest egg as you did to build it. After all, just because your paychecks stopped coming doesn’t mean your bills will.

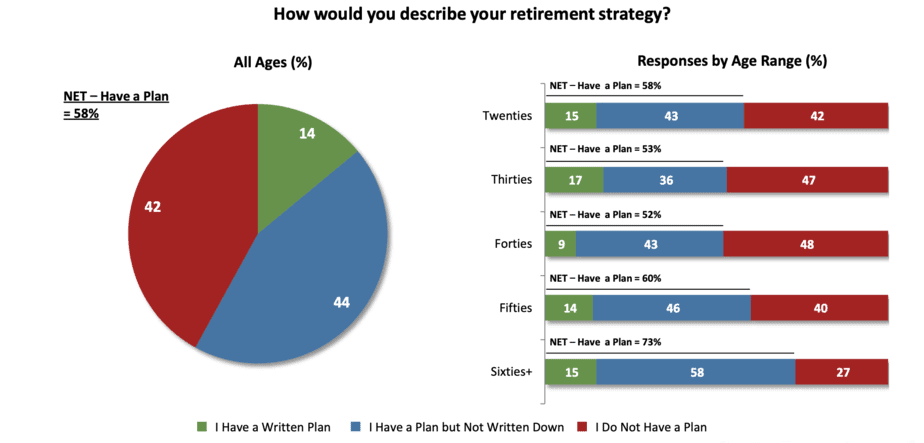

Number of American Workers With a Retirement Strategy by Age.

Even though retirement requires a strategic plan, 42% of American workers do not have a retirement strategy in place, as this research shows.

Source: transamericacenter.org

Estimating Your Expenses

To come up with a long-term financial plan, you must estimate your monthly expenses. You can use your last few years of expenses to estimate what you’ll spend after you retire.

Keep in mind that some expenses (work-related expenses and debt payments) will decrease during your retired years and others (like recreation and travel) will increase.

But you also must factor inflation into your expense estimates. Because of inflation, your buying power gets eaten up every year. Just imagine what that’ll mean after 20 or 30 years…

Unfortunately, we don’t have to imagine it. The LIMRA Secure Retirement Institute has created a model showing us what inflation will do to our Social Security benefits.

According to them, a 3% inflation rate (which has been the historical average), will cause more than $117,000 of your benefits will evaporate over the course of 20 years.

Ouch…

Plan Which Accounts You Will Use First

Besides planning for your expenses, you’ll also want to plan your income so you get the most out of your retirement accounts while paying the least tax.

You might have general investing accounts, government benefits, an IRA or Roth IRAs, a 401k or Roth 401 k account, or something else.

Each of these behaves differently and the whole situation is a minefield of taxes and penalties.

This is why getting with a financial planner to create a withdrawal strategy is so important.

Once you plan out your income and expenses, you’ll be better able to make your money last as long as you do.

Pitfall 5: Not Taking Market Fluctuations and Inflation Into Account

For some of us, pitfall 3 won’t cause any problems. Because you’re planners.

In fact, I’ve heard of some people that have planned out all their expenses from now until they’re 100 (and adjusted them for inflation).

They’ve got their retirement accounts set up. They know what the ultimate value of their portfolio needs to be, and they plan on living off 4% of their investments (under the 4% rule) every year.

That’s great. But what if inflation is higher than we think? Or interest rates are different? Or the return on our investments is much lower?

Don’t get me wrong… the fact that planning requires assumptions isn’t bad. But sticking to the plan, even when we realize our assumptions are wrong, is a pitfall that’s easy to fall into.

Instead, take a leaf from Warren Buffett’s book and stay on top of current trends and interest rates. If your investments have a return of 2% one year, maybe you don’t want to withdraw 4%. If there’s a 7% return, you can withdraw more.

Just go with the market flow.

Pitfall 6: Forgetting What Retiring Means To You Once You Get There

Learning How To Relax

One of the most unfortunate retirement mistakes is not knowing how to enjoy retired life!

After years of hitting the snooze button, fighting your way through traffic, and powering through afternoon drowsiness, many people find it difficult to transition to the retirement lifestyle.

What are you supposed to do when you don’t have to do anything? Take a nap? Go smell the flowers for the rest of your life?

It may seem ridiculous at first, but learning to relax is easier said than done. And relaxing is an art you must learn to get the most out of your retired years.

Create A Schedule

One of the most attractive parts of retired life is the freedom. You don’t have to punch a time clock or show up when they want you to.

Instead, you live your life doing what you want, when you want.

This is also one of the most disconcerting parts of retired living. Without the structure provided by your old job, the days may run together.

Unproductivity may depress your mood, and that TGIF feeling you used to get will be replaced by…blah.

To keep this from happening, consider creating a weekly schedule and fill it with whatever “work” and activities you find for yourself to do.

By creating your own structure and creating work/recreation (I dub it “workcreation”) for yourself, you’ll sidestep this problem and enjoy every day of your retirement.

What Are The Three Biggest Pitfalls To Sound Retirement Planning?

We’ve discussed six issues that can come up while you’re retired, but you can avoid many of these problems if you plan well and early.

With that in mind, let’s talk about some problems you may encounter while planning for retirement as well.

Some things you want to avoid are:

- Doing it alone

- Starting too late

- Underestimating healthcare costs

Doing it Alone

Retirement planning is complex.

There’s expense planning, investment planning, risk tolerance assessments, and more. Not to mention all the government rules you must navigate.

That’s why a financial adviser is so essential. Do yourself a favor and don’t go it alone. Instead, find the right financial planner to discuss the best way to retire early.

Starting Too Late

Starting to plan for retirement in your 50s and 60s is a huge mistake. Because by then retirement is so close and there’s little time to build savings or invest.

Doing it Only Once

Don’t create a plan and never look at it again. Instead, make sure you reevaluate your plan from time to time to make sure it still makes sense for you and your goals.

As your income changes, you can change your savings rate. Or as your risk tolerance changes, you can change your investment strategy.

It’s easier to make minor changes to your plan every year, than to make enormous changes after you’ve retired.

Final Thoughts

For most of us, retiring early is the goal – and a sweet, sweet goal it is. But it takes a lot of hard work to retire early, and there are a lot of problems you must avoid when you do.

Hopefully, you have a better idea of some issues the retired life can bring, and how to avoid them.

The list we have here is by no means exhaustive. So before you retire, consider as many scenarios as you can think of and plan for them all so that your retirement is everything you wanted it to be.

Cheers!

Idalmis

Latest posts by Idalmis (see all)

- Why Is Budgeting Important? 12 Best Reasons to Start Budgeting Today! - October 6, 2020

- How to be Frugal With Groceries. Must Try Tips! - September 15, 2020

- Is Skillshare Worth It? Best 2020 Review - August 31, 2020

I like the emphasis on how retirement does not retire the bills either. Tweeted and pinned as shared. Thank you.