Updated: May 20, 2020

Figuring out how to save money from salary is hard when you’re living paycheck to paycheck. You’ve got to juggle your living expenses, debts, and whatever you need.

It’s hard, but it’s doable if you’ve got the right strategies!

If you’re looking for tips on how to save money from your check, here are several tips that can help.

Contents

- 1 1) Budget For Savings

- 2 2) Keep Track of Your Spending to Save Money From Salary

- 3 3) Set Goals With Your Money

- 4 4) Reduce Your Paycheck Deductions

- 5 5) Try a spending freeze

- 6 6) Automate Your Savings

- 7 7) Save Your Raises and Bonuses

- 8 8) Reduce Your Debt Payments

- 9 9) Reduce Your Living Expenses to Save Money from Your Paycheck

- 10 10) Make Extra Money

- 11 Consistency

- 12 How Much Should I Save From my Salary?

- 13 What is the 50/20/30 Budget Rule?

- 14 All Set to Save Money From Your Salary?

1) Budget For Savings

To save money, you’ve got to get control of your money and to get control, you’ve got to have a budget!

If you don’t have a budget yet, start one today by writing your take-home pay and all your fixed and variable expenses.

Your fixed expenses (rent, insurance, and car payments) won’t change much from month to month, so you can’t do much to reduce those now.

But the amount you spend on variable expenses (meals, entertainment, travel, etc) can change depending on the choices you make.

You may also like: Save Money Live Better – Everything You Need to Know!

One of the best ways to save money from salary is to treat your savings like a fixed expense!

Choose a savings goal and write it down in your budget.

If you don’t have enough to pay all your fixed expenses including your savings, you’ll need to reduce your variable expenses to make it work (more on that later).

And don’t worry too much if you can’t stick to your budget perfectly. The fact that you’re trying at all will improve your financial situation.

2) Keep Track of Your Spending to Save Money From Salary

A lot of us start out feeling that our money is tight and that we just can’t save.

But often, once we become aware of how much unnecessary stuff we buy, we realize that we could save a lot if we didn’t overspend!

This is why tracking your spending during the month is one of the best ways to spend less and save more.

Expense tracking is the process of saving and categorizing your receipts as you go through the month.

You can track your expenses using Excel spreadsheets, or even pencil and paper. But saving your receipts, categorizing them, and then recording them in Excel or a notebook takes a lot of time!

But there’s a simple solution.

Use apps like Personal Capital, Empower, or Qapital and let the app track your spending for you!

Personally, we use Personal Capital because it can connect to our bank account and track our spending automatically.

We don’t have to save receipts, and the app categorizes all of our spending for us!

If that sounds down your alley, sign up for Personal Capital. It’s free!

3) Set Goals With Your Money

For some of us, the problem isn’t saving. The actual problem is being impulsive and using our savings to splurge.

One way to combat this problem is by setting goals with your savings.

For example, let’s say you’ve always wanted to see the Grand Canyon. Find out how much that trip will cost you and set a goal to save it.

Then, if you feel tempted to splurge, you’ll have to ask yourself if you’re willing to postpone your dream of seeing the Grand Canyon by a few months just so you can buy a trifle.

The answer will most likely be “no!”

4) Reduce Your Paycheck Deductions

Look at the deductions coming out of your paycheck. By doing this, you may find opportunities to save money from your salary.

There are deductions that act like expenses (i.e. donations, union dues) and deductions that act like savings accounts (i.e. your 401k).

If you want to save more money from your salary, cut back on deductions that are like expenses.

On the other hand, increasing your 401k deduction will boost your savings. You will have less take-home pay for sure, but that money will go to savings.

Related post: Creative Ways to Save Money.

5) Try a spending freeze

You may have a habit of overspending at certain times, like nights and weekends.

If that’s the case, try committing to no-spend weekends or no-spend nights. Just by knowing when you overspend you’ll be much more likely to put an end to it.

Or you may have trouble saving money because you overuse your debit or credit cards. In that case, consider carrying cash and leaving the cards at home.

It may surprise you how much money you can save!

6) Automate Your Savings

One of the best ways to save money is to make the process automatic.

Set up a direct deposit or automatic transfers to move the money into savings as soon as you get paid.

Or better yet, create a savings account in a different bank from the one you normally use.

Open a new savings account at CIT Bank and start earning 20x the national average with your savings account!

7) Save Your Raises and Bonuses

Another way to save money from your salary is to commit to doing it later.

Postpone your savings until you get a salary increase. Then, once you get a raise, save that additional money from each paycheck.

The trick is not to make any plans with your extra money or increase your spending at all.

The same idea works for any bonuses you get during the year. Any bonuses you get should go straight into savings, unless you need to pay down some debt!

8) Reduce Your Debt Payments

I can almost guarantee that debt is your biggest obstacle to saving.

If you’re serious about saving more money from your salary, then you’ve got to get rid of your debt, or at least reduce it!

Here are some common debt payments we have and what you can do about it!

Car payments

If you’re paying off an auto loan, one option to save more money from salary is to refinance your auto loan.

This option may make sense for you if,

You can get a lower interest rate now than when you financed the car

Your financial situation (and credit score) has improved since you got the car

The way it works is that the lender will pay off your old auto loan and issue you a new auto loan. The new loan may have a lower interest rate or a longer-term, but either way, your payments should be lower.

Credit Cards

First, call your credit card company and try to negotiate a lower interest rate. Be sure to let them know you’re thinking about switching to a competitor who’s offering a lower interest rate.

You could also transfer your credit card balance to a different card that offers a lower rate. Or better yet, transfer your balance to a card that’s offering a 0% promotional rate!

That means no interest charges during the promotional period! Just keep in mind that your rate will increase once the promotional period is over.

Student Loans

Consider signing up for an extended repayment plan. With this option, your monthly payment will be lower, but you’ll have to pay for a longer time. And because your loan term is extended, you’ll pay more in interest.

An Income-driven repayment plan is another option for those who qualify. This type of plan bases your monthly payments on your income. Again, you’ll pay more interest, but it might be worth it if you’re tight every month.

You could also consider refinancing your student loans. When you refinance, you take out a new loan for the current amount of your student loans. The new loan could have a lower interest rate or longer payment period and reduce your monthly payments.

If you want to look into refinancing be sure to shop around to see what’s right for you. One lender you can look at is Credible.

9) Reduce Your Living Expenses to Save Money from Your Paycheck

Even if you don’t splurge on things you don’t need, you can still find ways to save by lowering your basic expenses.

Whether it’s your food, utilities, or transportation expense, make sure you take advantage of every strategy that can help you save money.

Food budget

- Stick to a grocery list to avoid overspending

- Create a weekly meal plan

- Use cashback apps like Ibotta, Checkout51, or Rakuten to make money while shopping.

- Consider ordering groceries online, or using grocery delivery services like Instacart or Postmates, to avoid going in the store and making impulse purchases

Transportation

- Use public transportation if you can

- Make your bicycle your best friend

- Walk to work or the store whenever possible

- Drive slow to conserve gas

- Consider renting out your car with HyreCar to make some money on the side

Housing expenses

- Find ways to conserve electricity

- Rent a spare room with Airbnb to make money

- Find a cheaper place to live to reduce the cost of living

10) Make Extra Money

If you can’t squeeze any more savings out of your paycheck, an excellent option is to pick up a side hustle to make more money.

Some side hustle ideas include,

- Surveys with Pinecone Research, SurveyJunkie, or American Consumer Opinion

- Sell things you don’t need on Decluttr

- Sell electronics on Gazelle

- Making deliveries with PostMates

Whatever side hustle you pick up will definitely boost your savings.

You may also like: How to Become a Money Saving Machine

Consistency

Whatever you end up doing to save money from your salary, be consistent!

You may find that you have to dip into your savings every once in a while. Or things don’t go according to your plan every month but don’t give up.

How Much Should I Save From my Salary?

How much money you need to save depends on your salary, how large your expenses are, and even how much you need for retirement.

But for the longest time, the general rule was to save at least 10% of your income. But you should probably be saving 15-20% if you can.

The reason is that 10% probably won’t get you the retirement you want. Not with the rising cost of living and rising health care costs.

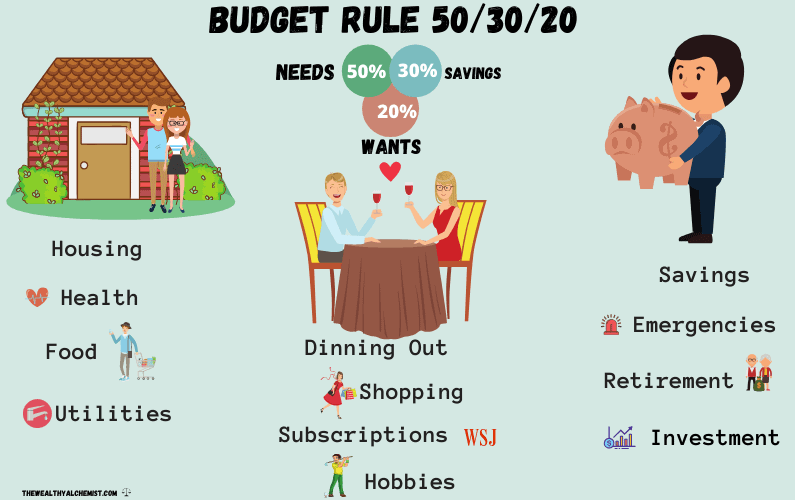

Consider using something like the 50/20/30.

What is the 50/20/30 Budget Rule?

The 50/20/30 budget recommends that you spend 50% of your income on needs, 20% on savings and debt, and 30% on wants.

Needs–50%

Use your budget to figure out how much you spend on necessities each month and limit it to 50% of your paycheck. This includes food, clothes, shelter, etc.

There’s a bit of a gray area in determining exactly what is a “need”. But an excellent rule of thumb is, if you need it to live (rent, heat, water) then it’s probably a need.

Wants–30%

Wants to refer to your gym membership, movies, your morning Starbucks, dining out, etc.

Under the 50/20/30 budget, try to limit those items to 30% of your paycheck.

Savings & Debt–20%

Use 20% of your take-home pay to pay off your old debts and create an emergency fund for the future.

But if your necessities eat up over 50% of your salary, these numbers aren’t going to work.

Or if 30% of your income is some huge number, it might be obscene to spend so much on things you don’t need.

That’s why you should probably think of these as a guideline instead of a rule. Depending on your situation, you may have to change these numbers.

All Set to Save Money From Your Salary?

If you haven’t gotten into the habit of saving money from salary, why not start saving today?

No matter what your financial situation is, you can learn how to save money on your paycheck by tracking your spending, lowering monthly expense or just by making more money.

And after you start saving money, make sure you set a goal for that money so you don’t end up spending it on something you later regret!

If you found these tips helpful or have another way to start saving money, let us know in the comments below!

Cheers!

You may also like: How Much Money Should I Have Saved For Retirement?

Idalmis

Latest posts by Idalmis (see all)

- Why Is Budgeting Important? 12 Best Reasons to Start Budgeting Today! - October 6, 2020

- How to be Frugal With Groceries. Must Try Tips! - September 15, 2020

- Is Skillshare Worth It? Best 2020 Review - August 31, 2020

automating your savings is the most important thing to do if you want to create a passive savings accumulation.

Yes! This can help a lot. Thanks!

Thanks for this, it’s super useful as I’m in the process of having an overhaul of our money at the moment, trying to cut expenses. Mich x

Thanks for stopping by! Cutting expenses could be hard sometimes, but with discipline you can do it!

These are some great idea! Definitely would help with paying off debt too.

We found that automating our savings really helped us, as after the first week or two we didn’t miss that money from our salaries.

There are some great tips you listed! I’m pretty sure most of us could use them!

Great tips. For me, creating a monthly budget and monitoring it is essential.