You’ve probably heard that TransferWise offers a cheaper way to send money abroad, but you want to learn more about it first. Read a TransferWise review or two, and get a few opinions, am I right?

I get it! In fact, I was in the same boat before using TransferWise myself!

Over the years I’ve made dozens of money transfers using my bank, MoneyGram, and Western Union.

And while each of those methods of transferring money has its own benefits and drawbacks, I can honestly say that TransferWise is one of my favorite ways to send money overseas now.

What makes it so great? Stick with me for a few minutes and I’ll tell you how TransferWise works, why it’s outstanding, and why so many people agree!

Contents

- 1 What is TransferWise?

- 2 Why is TransferWise so Cheap?

- 3 TransferWise Rates and Fees

- 4 Is it safe to use TransferWise?

- 5 Is TransferWise safe and secure for large amounts?

- 6 How fast is it to send money via TransferWise?

- 7 Countries you can transfer money with TransferWise

- 8 Steps to Transferring Money

- 9 How’s the customer service?

- 10 Borderless Bank Accounts

- 11 Is TransferWise better than Revolut?

- 12 Is TransferWise better than PayPal?

- 13 Pros and Cons of using TransferWise

- 14 The Verdict

What is TransferWise?

But let me take a second to explain TransferWise, in case you’re just now hearing about it for the first time.

At its core, TransferWise is a money transfer service that focuses on international money transfers. And it only transfers money from one bank account to another. (That’s right… no cash pickups.)

TransferWise came about because the inflated exchange rates and insane fees you see from banks frustrated the guys that eventually created it.

Their goal was to make the whole money transfer process easier and cheaper. And based on most people’s experience (including my own) they’ve succeeded!

But TransferWise doesn’t just make international money transfers. Since its creation in 2011, it has offered a multi-currency account for people who regularly use multiple currencies.

Here’s one of their videos giving a rundown of the company.

Why is TransferWise so Cheap?

You may wonder how does TransferWise work and if it’s as cheap as people say.

I get you on this one because money services typically aren’t cheap. But TransferWise’s low cost makes sense when you look at how they work.

The key to TransferWise is that it doesn’t actually transfer money across borders.

That’s right!

Instead of transferring money from country to country, it has bank accounts in several countries and in several currencies.

So, when someone wants to transfer money from the U.S. to Spain, their dollars move into TransferWise’s U.S. account and stay there.

Euros then transfer from TransferWise’s Spain account to the recipient.

Because it works like that, and because TransferWise doesn’t have as many costs as a bank, it can charge you the mid-market exchange rate (a.k.a., spot rate, or inter-bank rate).

That’s the real exchange rate you’d see on Google, Yahoo Finance, or Reuters, and it’s the best exchange rate you’ll find.

TransferWise Rates and Fees

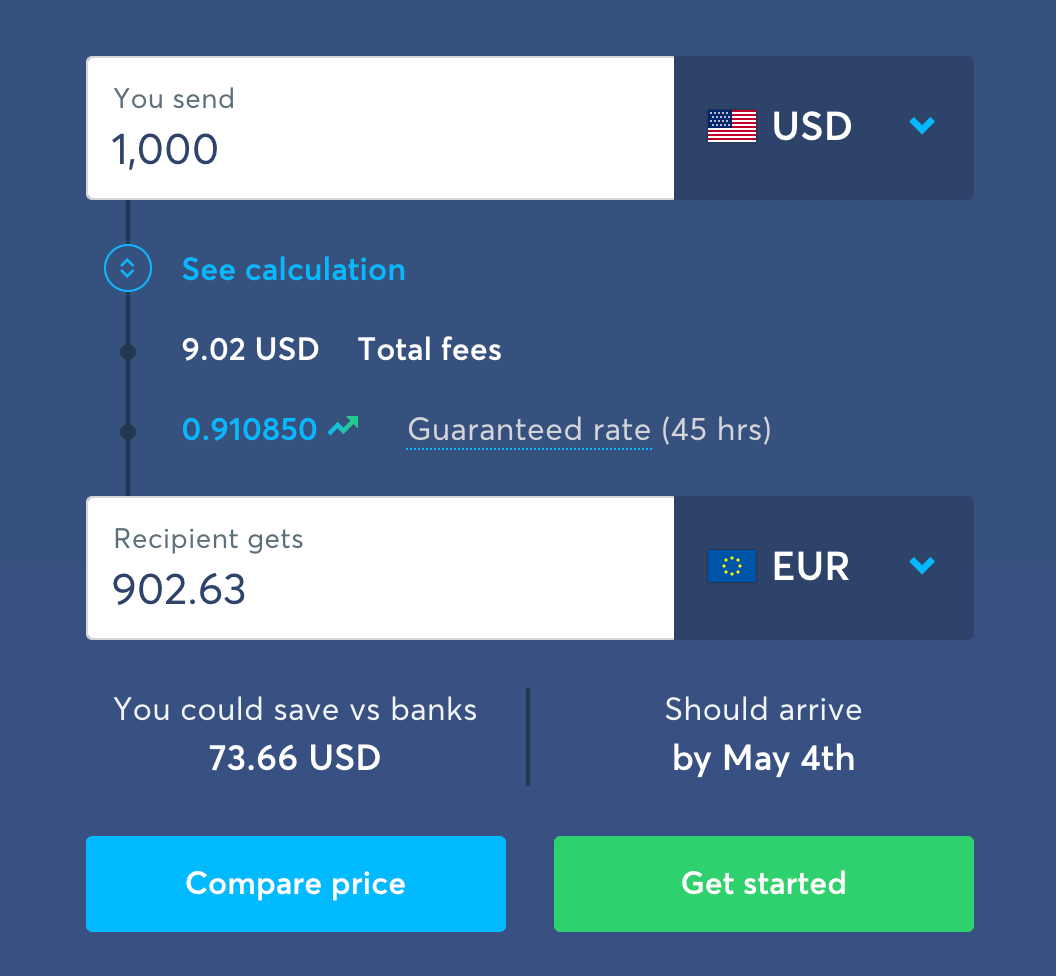

TransferWise built its business model on transparency, so they always clearly show their rates, and there are no hidden fees.

But how much does it cost to send a transfer? Well, that depends on a few factors.

- the currency exchange rates

- how much money you’re sending

- which payment method you select

The Exchange Rate

Before, I mentioned that TransferWise uses mid-market or real exchange rates, but I didn’t spend much time describing what that was. Let me give it a shot now…

Currency buyers want to buy for the lowest price, and currency sellers,, want to sell for the highest price.

The midpoint between those two prices would be the fairest price, called the mid-market rate. This is the rate that TransferWise uses when exchanging currencies.

Banks don’t offer you the mid-market rate. Instead, they hide additional fees in the exchange rate. That’s why the exchange rate they give you differs from what you’ll see on Google.

Because prices are constantly changing, the mid-market rate also constantly changes. But after you’re done setting up a transfer, TransferWise will guarantee your exchange rate for 24, 48, or 72 hours. It all depends on which country you’re transferring to and from.

As long as they receive your payment within that time frame, you’re all good!

How much money you want to send

TransferWise also charges you based on the amount of currency you will send.

So, if you send more, you pay more. But they’re very transparent about how much they’re charging you.

The fee is a percentage of the amount you send, and that percentage depends on the countries. If you want to check percentages for specific countries, you can check out their pricing page for more info.

For small transfers, a minimum fee may apply instead of a percentage-based fee.

Which payment method you select

How much you pay in fees depends partly on your payment method.

You can pay by:

- Credit and Debit Cards

- Bank transfer

- Apple pay or Google pay

- Other payment apps that are country specific

Credit and debit cards: You can pay with a Visa, MasterCard, and some Maestro cards (owned by MasterCard).

Paying with a debit card is the way I transfer money because it only takes a matter of seconds.

Using a debit card can also be cheaper because of the processing costs that go along with credit cards.

TransferWise

Built on transparency. No hidden fees. Upfront costs.

Bank transfer: You can also pay from your bank. After setting up the transfer, you can pay in person at your bank or through online banking.

Paying through your bank has lower fees than using a debit or credit card. But going through the bank could take 1 to 2 business days (sometimes more) because they have to verify your information.

Apple pay and Google pay: If you have one of these enabled on your phone you can use it to pay for your transfers. Learn how to pay with Apple or Google pay here.

Country-specific payment apps: TranserWise also has other payment options that are only available in certain countries:

- POLi payment – Australia,

- Boleto – Brazil.

- SOFORT – various countries in Europe

- iDeal – Netherlands

These unique payment methods come with different fees, but they’re all relatively cheap.

Is it safe to use TransferWise?

Yes, TransferWise is safe to use.

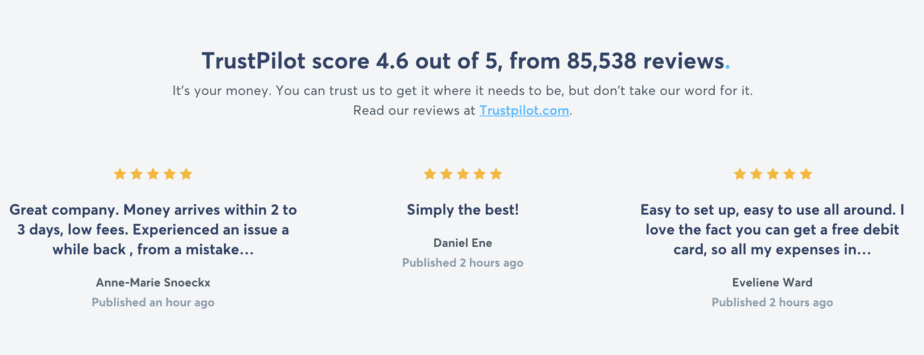

TransferWise has over 7 million customers that transfer over $5 billion every month. Over 85,500 users on Trustpilot have given a TransferWise rating of 4.6 stars. So, it’s a legit way to send money.

TransferWise registered with regulatory agencies in multiple countries, including

- The United States

- The United Kingdom

- New Zealand

- Japan

- Australia

- Belgium and the European Economic Area

- Canada

In my personal review of TransferWise, I’ve found it to be safe. But I send small amounts of money.

Most people I’ve come across who send a few hundred bucks don’t seem to have any issues either with their TransferWise experience.

Is TransferWise safe and secure for large amounts?

TransferWise is safe for large amounts. In fact, the founders of the company created TransferWise for sizeable transfers, like mortgage and rent payments.

But personally, I haven’t used TransferWise to send large amounts of money. (By large I mean several thousands of dollars). But remember, millions of people transfer billions of dollars every month with TransferWise and most their reviews are great.

They’re also regulated in various countries, so they’re required by law to keep your money safe.

But the heart of this question isn’t about safety. It’s about trustworthiness.

Is there any reason not to trust TransferWise with an enormous amount of money? Were other people screwed over when they used TransferWise?

That’s probably what you’re wondering.

Why Trust TransferWise?

The trust aspect depends on you and how comfortable you feel. But in most TransferWise review I’ve read, people say they’ve had no issues sending thousands of dollars with TransferWise. Some have even sent tens of thousands with no issues.

But there have been a few complaints. Some say that the transfer process took longer than it should have. Others complain that TransferWise requested additional documentation after the fact. And others say that their account was closed suddenly for no apparent reason.

Those stories are out there, but again, most of the reviews are great.

You May Also Like: Is Ibotta Legit- 2020 Ibotta Review.

How fast is it to send money via TransferWise?

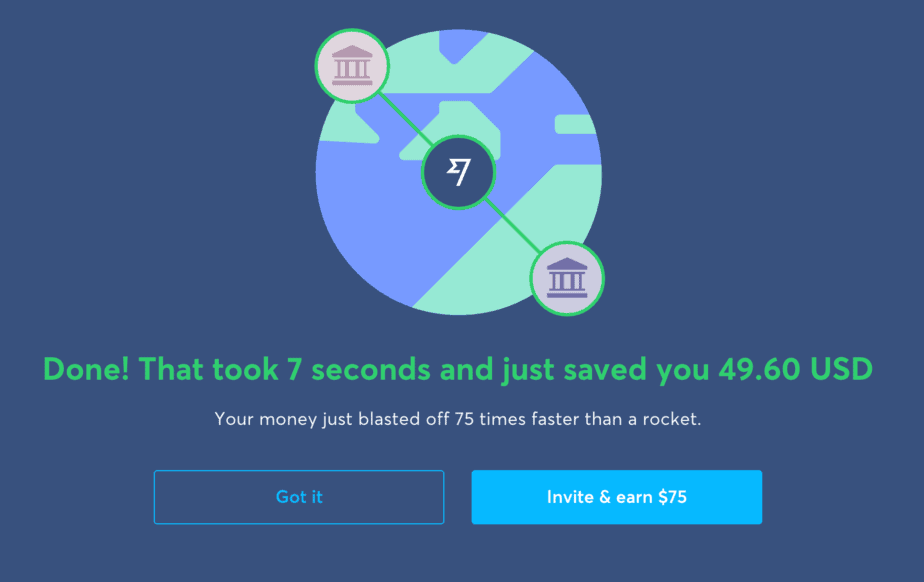

Sending money with TransferWise is usually fast! This was what amazed us the most when we first used TransferWise.

The first time we sent money abroad with TransferWise, it only took a few seconds to move the money from our U.S. account to our Spanish account. And yes, we logged in to our Spanish account to verify the money arrived!

The second time we sent money, TransferWise payment speed was slower only because we made the transfer on the weekend. Transfers made on weekdays happen in seconds, but if you do it on the weekend TransferWise has to wait for the banks to open to complete the transfer.

For many people, weekday transfers happen in a matter of seconds, but TransferWise speed can vary depending on a few factors.

- The countries and currencies involved in the transfer

- Your payment method

- What time you send the transfer

- ID verification

Note: Here’s an example of how long it took for TransferWise to send my money to Spain on a weekday.

The country you’re sending to and from: The transfer can take up to two business days depending on the currencies and the processing speeds of the sending and receiving banks.

Your payment method: You can complete your transfer in seconds if you pay with a debit or credit card. But paying with the bank usually takes longer.

The time you send the transfer: Banks will only move currency during normal working hours. So if you start a transfer on the weekend, it’ll take longer than if you sent it during the middle of a weekday.

Possible ID verification: Sometimes, TransferWise wants to verify your information. The TransferWise verification process will make your money transfer take longer.

Countries you can transfer money with TransferWise

TransferWise sends money to many countries in the Americas, Europe, Africa, and Asia. But for some countries, they can only transfer money into the country, not out.

For a complete list of which countries are available, check out TransferWise’s country list.

Even if you don’t see the country you want on their list, you can vote to have that country added to their service.

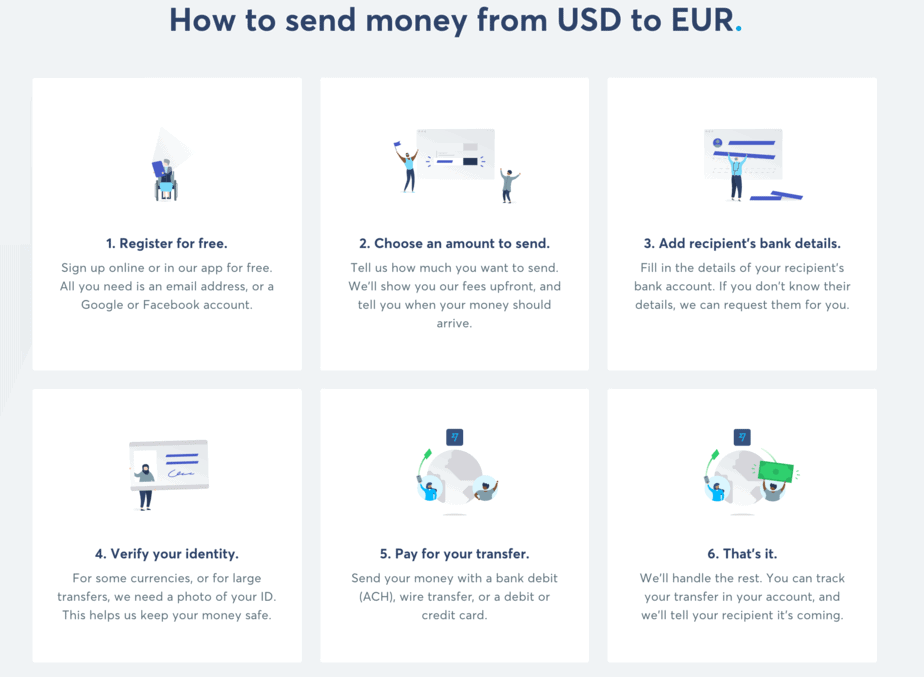

Steps to Transferring Money

Now, let’s talk about how to use TransferWise step by step.

The first step in sending money with Transfer Wise is to create an account. You can do with this by creating a TransferWise sign up with an email address, or with your Google, Facebook, or Apple ID:

Once you’ve got your account setup, sending money is a simple 4 step process.

- Enter the amount you want to transfer, the sending currency, and the receiving currency.

If you want to check out how much money it’ll cost you check out the TransferWise widget on their homepage and enter the amount you want to transfer.

2. Create a sender profile. This will either be personal information (your name, phone number, and address) or if the sender is a business, it’ll be business info.

3. Create a recipient. The recipient can either be yourself, someone else, or a business or charity.

4. Review your transfer and select your payment method.

5. Track your transfer online. You want to make sure that everything is working just fine with the money you sent.

How’s the customer service?

By most accounts, TransferWise has excellent customer service.

Most TransferWise review mention that their customer service reps are pleasant and helpful. But they’re not available 24/7. Customer service is on call only on weekdays.

Borderless Bank Accounts

TransferWise’s borderless bank account lets you spend, send, and receive money around the world with one virtual bank account.

Once you create an account, TransferWise can give you a local bank account in any country they have available. For example, if you want to get paid in the U.S. and spend dollars, you can get a routing number and account number just like you’d get from any U.S bank.

Or if you spend time in England and want to get paid in pounds and spend pounds, you can get the account details for an England-based bank account.

And you can hold up to 50 different currencies in your Borderless Bank Account!

You’ll get a TransferWise debit card that you can use to pay in any currency. And it’s accepted everywhere MasterCard is.

TransferWise also lets you convert between the various currencies you have in your Borderless Bank Account at the real exchange rates.

So, if you’re a traveler, freelancer, or nomad, this one might be for you!

Is TransferWise better than Revolut?

TransferWise and Revolut have a lot in common.

Both focus on cheap international money transfers, they both also offer multi-currency accounts, but there are some significant differences as well.

Let’s take a quick look at the biggest differences.

Transfer fees

TransferWise charges you the mid-market rate for exchanging currencies, which is the best exchange rate you can get. But they also charge you a percentage fee when you exchange currencies.

Revolut may charge you more than the mid-market rate, which is not as good. But there are no fees for transferring up to 5,000 pounds per month (or the equivalent for whatever currency).

Also, TransferWise’s Borderless Banking account doesn’t have monthly fees. Revolut’s account doesn’t charge monthly fees for its standard membership, but their premium and metal memberships have a charge.

Withdrawal fees

Both TransferWise and Revolut offer debit cards with their multi-currency accounts. But both limit your ATM withdrawal to 200 pounds per month.

If you go over this amount, TransferWise will charge you 2%. While Revolut will only charge you 0.5%.

Products

TransferWise focuses mainly on money transfers and currency exchange.

Revolut does this too, but it also has other products such as:

- Insurance

- Cryptocurrencies

- Lets you round up purchases to save money

- Built-in budgeting features

Which is better?

The best one for you depends on what you need.

If you plan on traveling around and withdrawing a lot of cash wherever you go, then Revolut may be better for you.

But if your focus is making and receiving payments, and making international transfers, then you may want to go with TransferWise.

Is TransferWise better than PayPal?

TransferWise and PayPal serve different needs.

TransferWise’s primary focus is international transfers and currency exchange. With TransferWise, you can send money to friends whether or not they have an account with TransferWise.

PayPal is for online payments and for transferring money to friends who use PayPal. It’s fine for domestic transfers, but once you make international transfers with PayPal, you will pay a lot.

So, if your primary purpose is to exchange currencies or send money overseas, you’d be better off with TransferWise.

Pros and Cons of using TransferWise

Pros

- They offer the mid-market exchange rate

- Can make international transfers in various currencies

- Quick transfer speeds

- Multiple payment methods

- Transparent fees

- Excellent user experience

- Easy to set up a free online account

- No minimum transfer amount

- Excellent customer service

- A 4.6 star rating on Trustpilot with over 85,500 review

Cons

- Paying with your bank account can take longer

- Only bank to bank transfers are available.

- No cash pickup option

- Transfers are sometimes slower than traditional services

- Occasional account terminations

The Verdict

TransferWise offers excellent money transfer services. The only thing I’m bummed about is that I didn’t discover it sooner!

I hope you found this TransferWise review helpful and now have a clearer idea of how the company works.

If you’re thinking about traveling and want to have easy access to different currencies, or if you need to send money across borders, TransferWise is definitely worth checking out!

Cheers!

Idalmis

Latest posts by Idalmis (see all)

- Why Is Budgeting Important? 12 Best Reasons to Start Budgeting Today! - October 6, 2020

- How to be Frugal With Groceries. Must Try Tips! - September 15, 2020

- Is Skillshare Worth It? Best 2020 Review - August 31, 2020