How would you like to win the money game? You can do it, and the Dave Ramsey plan can help. It’s the method he teaches Financial Peace University and is more commonly known as the seven baby steps to financial freedom!

So, what are Dave Ramsey’s baby steps?

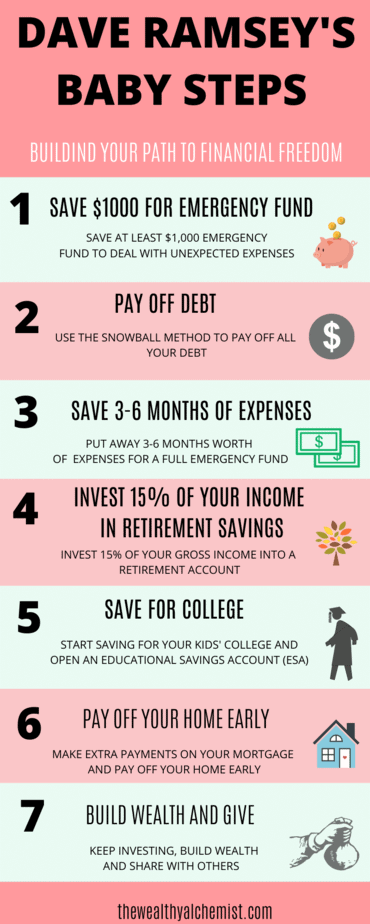

| Baby Step 1: | Save $1,000 for an emergency fund. |

| Baby Step 2: | Use the Dave Ramsey snowball method to pay off your debt. |

| Baby Step 3: | Save 3-6 months of expenses for your full emergency fund. |

| Baby Step 4: | Invest 15% of your income for retirement. |

| Baby Step 5: | Save for your children’s college fund. |

| Baby Step 6: | Pay off your home mortgage. |

| Baby Step 7: | Build wealth and give. |

These baby steps to financial freedom are as simple as they appear. But they’re difficult to do!

But don’t worry, we’re going to walk you through each of the Dave Ramsey baby steps and show you how you can accomplish each one!

Baby Step 1: Save $1,000 for your starter emergency fund

Why to follow baby step 1:

Sixty-four percent of us are stressed about money. Stressed about things we need but can’t buy. And stressed about problems that’ll appear that we can’t afford to fix.

While you won’t be able to solve every problem with money, having that emergency fund in the bank will go a long way to reducing your stress levels.

Not only that but if you don’t have savings when a problem does appear, you’ll probably end up going into more debt to fix it.

That’s why it’s crucial to build yourself an emergency fund before you do anything else.

How to follow baby step 1:

Building an emergency fund isn’t easy, because it requires you to change your habits. You’ll have to budget your money, keep track of your expenses, and cut back on spending as much as possible.

But don’t worry, you won’t have to input your receipts into a spreadsheet! Nowadays there are apps to make it as easy as possible. Setup a Personal Capital account or sign up with Empower to start tracking your spending habits and cut back where you can.

Food will most likely be an area you can save big on. There’s a tremendous amount of food wasted every day, but with the right tips, you can reduce this waste and save yourself some money.

Other potential areas to cut back on are your date night out, phone expenses, and household items.

Cutting down your expenses is the first option, but you can also increase your income to save money faster. Some quick ways to make money are to,

- have a garage sale,

- use eBay or Decluttr to sell some of your things,

- start delivering part-time with PostMates,

- become a dog-sitter or walker with Rover

- sell photos to Shutterstock

ProTip: You worked hard to build your savings. The least your savings can do is work hard for you! But chances are your money is barely earning any interest in your normal savings account. If you want to earn 20x the national average with your savings, sign up with CIT Bank and start earning today!

Baby Step 2: Use the snowball method to pay off your debt (except for your home)

How Baby Step 2 works

With the Dave Ramsey snowball method, you make the minimum payments on all your debts while throwing every spare dollar you can at your smallest debt.

Once your smallest debt is paid off, take the money you were using to pay the smallest debt, and start paying the next smallest.

You go on like that until you wipe out all your debt!

Why follow Baby Step 2?

Many people say that it’s better to pay the debt with the highest interest first because mathematically, it works out to be less expensive that way. (This is also known as the avalanche method)

That’s true, of course, but the problem is that most of us don’t make money decisions based on careful mathematical analysis. If we did, we couldn’t end up buried in debt!

Instead, we tend to make financial decisions based on emotions and psychology. That’s what makes Baby Step 2 so effective. It’s structured to give us quick wins and the psychological motivation needed to keep making progress.

In fact, researchers for the Harvard Business Review have found this to be the case and conclude that the snowball method is more effective than the avalanche method.

Related Posts: How to effectively set the right financial goals

Baby Step 3: Save 3-6 months of expenses for your full emergency fund

If saving $1,000 was hard, it may seem even more daunting to save 3-6 months of expenses.

But, after you’ve knocked out your debt, saving a 3-6 month emergency fund should be easier. Just keep the same mentality you had when you saved $1,000 and paid off your debt.

Why does Dave Ramsey recommend 3-6 months?

The amount of savings you should have is based on how risky your job situation is.

For example, take a two-income household. If both partners have steady, safe jobs, they probably don’t need to have a huge emergency fund. Three months may be fine.

Now, imagine a one-income household. If the person working outside the home doesn’t have a steady income or works on commission, they may need a much larger emergency fund because it’s a much riskier situation.

Are 3-6 months too much, too little, or just right?

There are a number of money gurus out there that recommend different amounts for your emergency fund.

Some say that 3-6 months is too much. Their opinion is that you’d be better served putting some of that money to work earning interest.

Others, like Suze Orman, say that 3-6 months is too little. They believe that if you lose your job or get sick, you may need as much as a year!

Despite what the gurus say, you’re the expert on your life. You know your cost of living, job stability, health issues and everything else. You have to feel secure with your emergency, whether it’s for 3 months or 12. Assess your situation and save as much as you need to so you can sleep soundly at night.

How do you build up that kind of savings?

Now that your debts are paid, you shouldn’t have too much trouble stashing away the money. But there are some budgeting methods that can help you with this task.

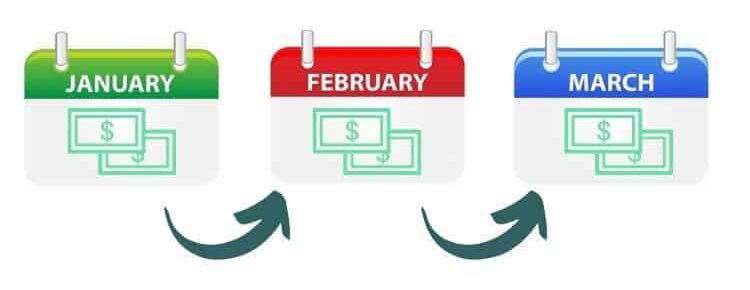

Age your money

You Need A Budget (YNAB) has a method called “Age Your Money”. The goal of this method is to stop you from paying this month’s bills with this month’s paycheck. Instead, you should be paying your current bills with money you earned weeks or even months ago.

To use this method, you have to consistently spend less than you earn (which you should be doing since you’re out of debt). The extra money you have will roll over into the next month, and eventually, you should be able to pay next month’s expenses with money earned last month.

Keep this up for a while and you should get to a point where you’re paying your current expenses with money that you earned 5, 6 or 7 months ago! And voila, you’ve enough money in the bank to cover 6 months of expense!

50/30/20 budget

Another method is to use the 50/30/20 budget rule to control your money. With this budget,

- 50% of your income goes to things you need,

- 30% goes to the things you want,

- 20% goes to saving and debt

Once you’ve spent the maximum allowed, you’re done with that category. Of course, if your needs make up less than 50% of your income, you can adjust the percentages. This is just one of several budgeting methods to control where your money goes.

Baby Step 4: Invest 15% of your income for retirement

Why does your emergency fund have to be fully funded before you begin this step?

When you run into problems, you’ll probably have to dip into your retirement account for cash unless you have a fully-funded emergency fund. This is why it’s important to complete baby step 3 before you start on baby step 4.

Why follow Baby Step 4?

In this step, Dave Ramsey recommends that you invest 15% of your gross income.

Why not more? Because you’ll probably need to do steps 4-6 simultaneously, and you don’t want to underfund these steps.

Why not less? Because it’s important that you put enough towards your retirement. After all, you don’t want to rely on Social Security for your livelihood.

How to follow Baby Step 4?

Dave Ramsey recommends that when it comes to retirement, you save with “tax-favored” dollars whenever possible. All this means is that your savings/investment receive special tax treatment.

You can get this special tax treatment with a 401(k) or IRA account.

401(k)

A 401(k) is a profit-sharing plan offered by some employers. It allows you to contribute part of your income to your own individual account.

The great thing about 401k plans is that your employer may contribute to your account. With the regular 401k, you won’t pay taxes on the contributions you make, but you will pay taxes when you withdraw the money.

A Roth 401(k) is similar, only you pay taxes on the contributions, and you don’t pay taxes when you withdraw the money.

IRA

An individual retirement arrangement (IRA) is a tax-favored arrangement that allows you to set aside money for retirement.

With the traditional IRA, you may be able to deduct your contributions for tax purposes, but you will have to pay taxes on distributions.

The Roth IRA, on the other hand, does not allow you to deduct contributions, but you won’t have to pay taxes on distributions.

Baby Step 5: Save for you children’s college fund

With the rising costs of college tuition, there are some who say you’re better off learning a trade than going to college. But if you’ve got kids and you want to pay for their college education, your best course is to start saving early.

There are two plans that can help with this.

- Education Savings Account (ESA)

- 529 Plans

Education Savings Account (ESA)

ESA’s are only available for families that don’t make more than $95,000 (single) or $190,000 (married filing jointly).

For those that meet the income limitations, ESAs allow you to contribute up to $2,000 a year, per child. You can then invest the account in stocks, bonds, or mutual funds to earn a return.

Keep in mind you do have to pay tax on the money you contribute to the account. But distributions from the ESA are tax-free if they’re used to pay for qualified education expenses like tuition, books, and uniforms.

FYI: If you created an ESA for you child and they decide not to go to college, you can transfer the account to a sibling for their education.

529 Plans

These plans are similar to ESAs, but there are no income limitations.

The catch is, that 529 Plans are created by individual states so they’re all unique. Some give you more control, some give you less. Here’s a great article from Policy Genius that breaks down 529 Plans by state.

Baby Step 6: Pay off your home

After completing baby steps to financial freedom 1-5, you should be in a great position to make extra payments on your mortgage.

Keep in mind that some mortgage companies actually penalize you for making early payments. So, check with your mortgage company to see what their policy is.

Also, make it clear to them that your extra payment should be applied to the principal balance, and not just to next month’s payment.

Make payments biweekly instead of monthly

Instead of making a payment every month, make a half-payment every 2 weeks.

This will result in 26 half-payments, or 13 full payments every year. While it may not seem like that much, that extra payment could shave a few years off your mortgage.

Round up your payments

By rounding up you can reduce the term of your mortgage. So, instead of paying $1,373 (or whatever) each month, round up your payment to $1,400.

To figure out what works best for you try this mortgage payoff calculator.

Baby Step 7: Build wealth and give

This is the final step of the journey. If you’ve arrived here, congratulations!

Basically, you just need to keep doing what you’re doing. Keep investing and building your wealth.

But why does Dave Ramsey recommend giving in one of his baby steps to financial freedom? One reason is that giving makes you a happier person.

Another reason is that a tight fist holds on to its money, but it’s also not open to receiving any.

This isn’t something that only Dave Ramsey has commented on either. As Tony Robbins has said many times, “the secret to living is giving”.

Final Thoughts on Dave Ramsey’s Baby Steps to Financial Freedom

Dave Ramsey’s 7 baby steps to financial freedom are easy to understand, but they’re hard to do because they require change.

If you stumble on one of the financial baby steps and have to start over, no worries! You can tackle them again and again until you achieve success.

The important part is to keep going until you achieve the financial freedom you’ve always dreamed of.

Cheers!

Oliver

Latest posts by Oliver (see all)

- 26 Best Personal Finance Tips To Rock Your Money! - November 18, 2020

- How Much is 6 Figures? Epic Salaries Explained. - September 10, 2020

- Is Ibotta Legit? The Most Complete Ibotta Review 2021 - April 15, 2020